Despite a steady stream of taxes being collected from traders, companies, and private sectors in Juba, South Sudan, the city seems to be stuck in a cycle of inefficiency. Improvements in essential services such as garbage collection and security remain elusive, with funds often disappearing.

The Juba City Council, tasked with managing these funds under the local government of Central Equatoria State, appears to be falling short of delivering tangible benefits to its citizens.

According to the State Revenue Authority Act of 2007 which was amended in 2008 and 2014, the authority should oversee and consolidate revenue mobilization to ensure effective monitoring and accountability. Yet, the reality on the ground suggests a different story.

Frustrations of local traders

In an interview, Uywak Dominic, a trader who runs a bar business, expresses his frustration. He states that he always pays all types of taxes as demanded by the Juba City Council, but the collected taxes do not translate into services. His shop has been targeted by thieves, and no security measures have been implemented after the taxes are collected.

“For security, we always pay monthly. From my own experience, I lost valuable items and have been paying the security fee every month. I even reported to the department responsible for the economy—the people who collect money for security in Juba City Council—but I have yet to recover my lost items.”

Uywak reveals that besides taxes, there are other fees they pay, but he does not know what the City Council uses the money for.

“I fail to understand why we are paying this money. We are charged service fees, but they do not explain exactly what services they provide. They come to your place and claim to be from the City Council’s service fees department, demanding a certain amount.”

He continues that, “there is no opportunity for a trader to explain themselves. When they visit your shop, they leave a demand note and give you 3 or 4 days to pay. If you do not report to their office and begin the payment process, they come to your place and shut down your shop until you pay the service fee, which we do not even know the purpose of.”

Dominic wonders why the City Council has a specific department called revenue when all the taxes collected fall under revenue.

Issues with garbage collection

Regarding garbage collection, Dominic adds that “I am also a victim of this. Initially, they took 50,000 South Sudan Pounds, which we pay monthly. They collected the money but did not come to collect the garbage for a month, resulting in a filthy environment and customer complaints. When they did come to collect the garbage, they again demanded money despite not having done their job properly.”

He notes that, in addition to poor services, the Juba City Council intimidates taxpayers who do not pay their taxes, often locking the shops of those who fail to comply.

“In fear of my business being shut down, I have been threatened with closure if I do not pay. They charge 5,000 to 10,000 South Sudan Pounds to open the padlocks they use to shut down businesses.”

Increased tax rates and poor services

According to Uywak Dominic, he pays 4,000 South Sudan Pounds ($0.8) per month as a security fee and 50,000 South Sudan Pounds ($10) per month for garbage collection. The amount of tax varies depending on the size of the business.

One of the businesswomen operating in Custom Market, Rose Santo Tombe, who does tailoring, says traders face many challenges from the Juba City Council in terms of tax collection. She notes that there are no services provided to traders in Juba.

Rose explains that, “the City Council keeps increasing the fees, and they collect garbage only once a month. The constant fee hikes make it unclear whether Juba City has a relationship with the dollar since the more the dollar rate goes up, the higher the taxes.”

She highlights that the garbage fee, which used to be 8,000 South Sudan Pounds ($1.6) has now tripled to 24,000 South Sudan Pounds ($4.8) per month. Restaurant owners, who previously paid 50,000 South Sudan Pounds ($10), now pay 150,000 South Sudan Pounds ($30), while salon owners, who once paid 40,000 South Sudan Pounds, ($8), now pay 120,000 South Sudan Pounds ($24) for garbage collection alone.

Mama Tabisa Edward, another business owner, points out that while the taxes used to be reasonable, they have now increased threefold, and services, particularly garbage collection, have deteriorated.

“Previously, taxes were understandable, but now they have increased significantly, and the services have not improved, especially garbage collection. We are paying street children to manage the garbage because the city remains dirty.”

She adds that “last year, we paid 8,000 South Sudanese Pounds ($1.6) per month for garbage collection, but now it’s 24,000 South Sudan Pounds ($4.8). Restaurant owners now pay 150,000 South Sudan Pounds ($30), up from 50,000 South Sudan Pounds ($10), and salon owners pay 120,000 South Sudan Pounds ($24), up from 40,000 South Sudan Pounds ($8), for garbage collection only, without seeing any improvement in services.”

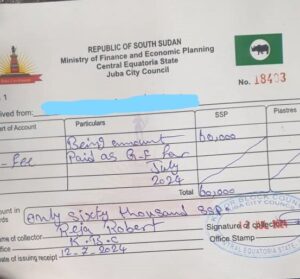

Document with data of how the Revenue have been collected

According to the Juba City Council Solid Waste Management Master Plan Document 2021-2030, produced with the assistance of Japan International Cooperation Agency (JICA). Total revenue of Solid Waste Management in JCC-DES for 10 years is approx. 2,690 million SSP.

Below is the the Data showing the Total Tax Collection for Waste Management on Traders from 2020-2024

Main independent revenue source is waste collection fee from market and business (approx. 1,737 million SSP, 65 %). However, these revenues are not sufficient, especially until 2022 due to lack of waste collection capacity and fee collections, and financial support from general account of JCC (approx. 68 million SSP) would be required.

In the mid-term plan, ratio of independent revenue sources would be approx. 99.5 % by reaching 75% of collection rate of waste collection fee from market and 50 % from business, and in the long-term goal, ratio of independent.

Below is the data showing the percentage Tax Revnue of Solid Waste Management from Wast Collection (Market & Business) in Juba City Council

The document also indicated that, the revenue sources would be approx. 99.6 % by reaching 90% of collection rate of waste collection fee from market and 74 % from business. Independent revenue sources other than waste collection fee are permission fee of private operators, waste collection vehicle maintenance fee from Blocks and Fines, which consists of approx. 7 % of total revenue. (Click the link of Source Document under the data and read more in the document)

Concerns about misuse of funds

Robert Pitya, the chairperson of the Chamber of Commerce in Central Equatoria State, states that the taxes collected from traders and other private sectors are not being used correctly to provide services to the people of South Sudan.

“Services should be funded through taxes, including building schools, health centers, and managing waste. However, this is not happening as expected because the collected taxes are not directed properly, resulting in neglected health facilities. When you visit a local health facility, it is very expensive because the taxes are not used for these services.”

He adds that despite all the taxes collected, people in South Sudan continue to struggle with hunger and lack of medication.

“If you go to Juba Teaching Hospital, you will find that some drugs are missing, forcing you to seek expensive treatment at private hospitals. These are issues the government should address through the taxes they collect.”

Pitya also notes that while taxes have been imposed on traders and local products produced within the country, infrastructure challenges persist, impacting the ease of trade.

“At the moment, traders are not benefiting from the taxes collected by the government in the city,” he emphasized.

Governor’s concerns and new revelations

On August 15, 2024, Governor of Central Equatoria State, His Excellency Augustino Jadalla Wani, revealed that individuals in City Council uniforms are collecting taxes in the market but are not providing services as required by the government.

“There are criminals posing as City Council officials, collecting taxes in the market without authority. We need to remove them, as they are not authorized by the City Council. We have discovered that some people in City Council uniforms are not holding high ranks,” he said.

Governor Jadalla regretted the lack of proper offices within the City Council to control tax collection in the market.

“If there is no strong authority in the market to oversee tax collection, issues will arise that you may not be aware of.”

New administration’s findings

On August 15, 2024, the new governor’s press secretary revealed that the former governor of Central Equatoria State, Emmanuel Adil Anthony, failed to remit funds to the State Ministry of Finance’s bank account. Press Secretary Waakhe Simon Wudu stated that the former administration rarely facilitated cash transfers, with revenue-generating institutions failing to remit funds through the bank.

The press statement from the governor’s office indicated that the previous administration undermined state policies, leading to the misuse of state revenue.

Wudu emphasized that the new government’s committee found that revenue was not being remitted to the bank and was being managed physically, which contributed to misuse.

“When the governor took office, he discovered that some revenues were not being banked and were being managed physically, promoting misuse of the funds.”

Urgent call for reform

As Juba city grapples with inadequate services despite hefty taxes, residents are demanding significant changes. Uywak Dominic, a local trader, has voices his frustrations, underscoring the desperate need for transparency and accountability in tax collection and service provision.

Dominic emphasizes that it is crucial for both local authorities and the government to, “address these issues, ensuring that taxes collected are properly allocated and directly benefit the community.”

Adding weight to this plea, Rose Santo Tombe insists that residents of Juba must take an active role in holding officials accountable. She argues that, “to prevent the misuse of funds and to foster a system that truly serves the needs of its citizens,” rigorous oversight is necessary.

This Story Was produced with Support from InfoNile and Traget Media